Emery County School District

2020 Bond Election

Tax Impact & Bond Finances

Downloadable PDF

Estimated Project Costs

Below is a table showing the maximum anticipated annual tax impact for a variety of property values. All amounts are approximate, rounded to the nearest dollar, and based on projections. It is expected that in most years, the actual tax impact will be less.

Property Value Primary Residential Home Business

$120,000 $130 / year ($11 / month) $237 / year ($20 / month)

$150,000 $163 / year ($14 / month) $296 / year ($25 / month)

$200,000 $217 / year ($18 / month) $394 / year ($33 / month)

$250,000 $271 / year ($23 / month) $493 / year ($41 / month)

$300,000 $325 / year ($27 / month) $591 / year ($49 / month)

$400,000 $434 / year ($36 / month) $788 / year ($66 / month)

$500,000 $542 / year ($45 / month) $985 / year ($82 / month)

Property Tax Payers

Over the last 5 years, on average, personal & real property tax payments have accounted for 16.6% of total property taxes paid in Emery County.

Centrally Assessed properties such as Mining Operations and Power Plants have accounted for 83.4% of property taxes paid in Emery County.

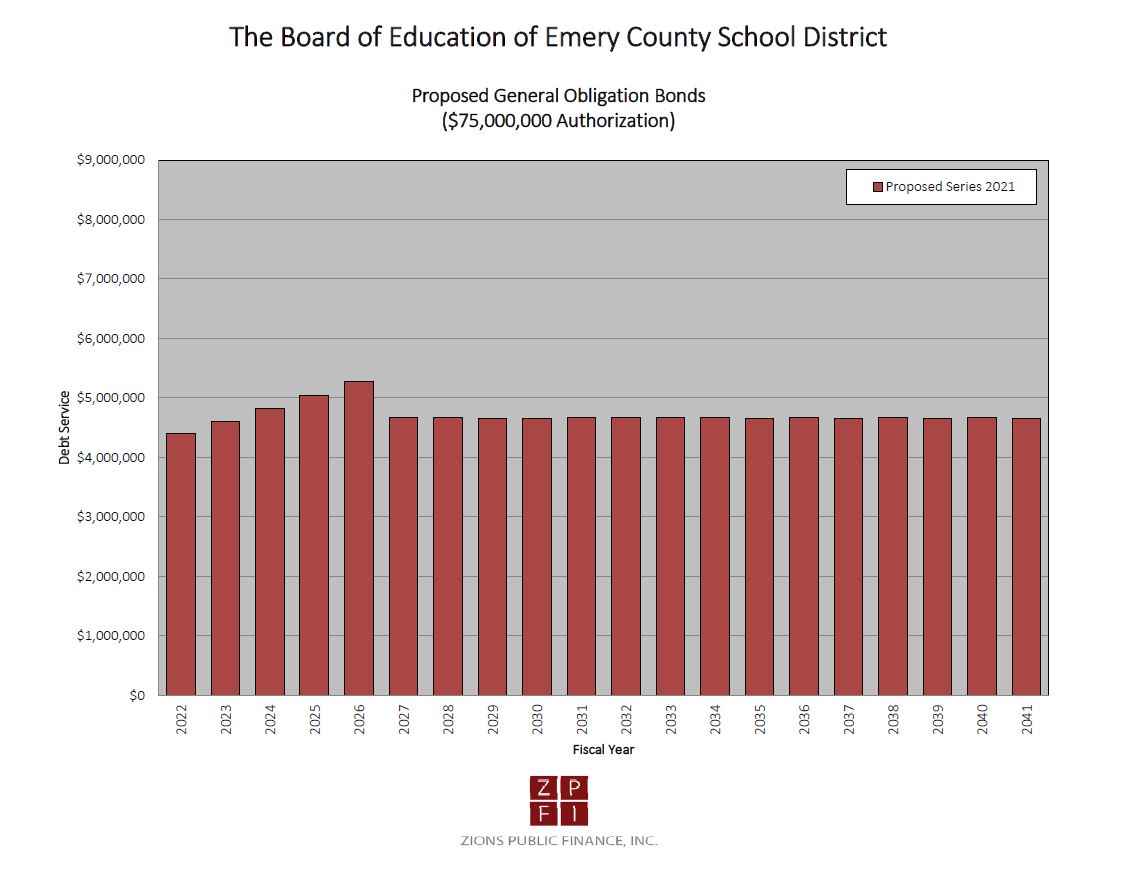

Projected Payment Schedule

2020 Bond Election

Tax Impact & Bond Finances

Downloadable PDF

Estimated Project Costs

- Emery High School - $55 million

- Ferron Elementary School - $20 million

- Book Cliff Elementary School - $500,000

Below is a table showing the maximum anticipated annual tax impact for a variety of property values. All amounts are approximate, rounded to the nearest dollar, and based on projections. It is expected that in most years, the actual tax impact will be less.

Property Value Primary Residential Home Business

$120,000 $130 / year ($11 / month) $237 / year ($20 / month)

$150,000 $163 / year ($14 / month) $296 / year ($25 / month)

$200,000 $217 / year ($18 / month) $394 / year ($33 / month)

$250,000 $271 / year ($23 / month) $493 / year ($41 / month)

$300,000 $325 / year ($27 / month) $591 / year ($49 / month)

$400,000 $434 / year ($36 / month) $788 / year ($66 / month)

$500,000 $542 / year ($45 / month) $985 / year ($82 / month)

Property Tax Payers

Over the last 5 years, on average, personal & real property tax payments have accounted for 16.6% of total property taxes paid in Emery County.

Centrally Assessed properties such as Mining Operations and Power Plants have accounted for 83.4% of property taxes paid in Emery County.

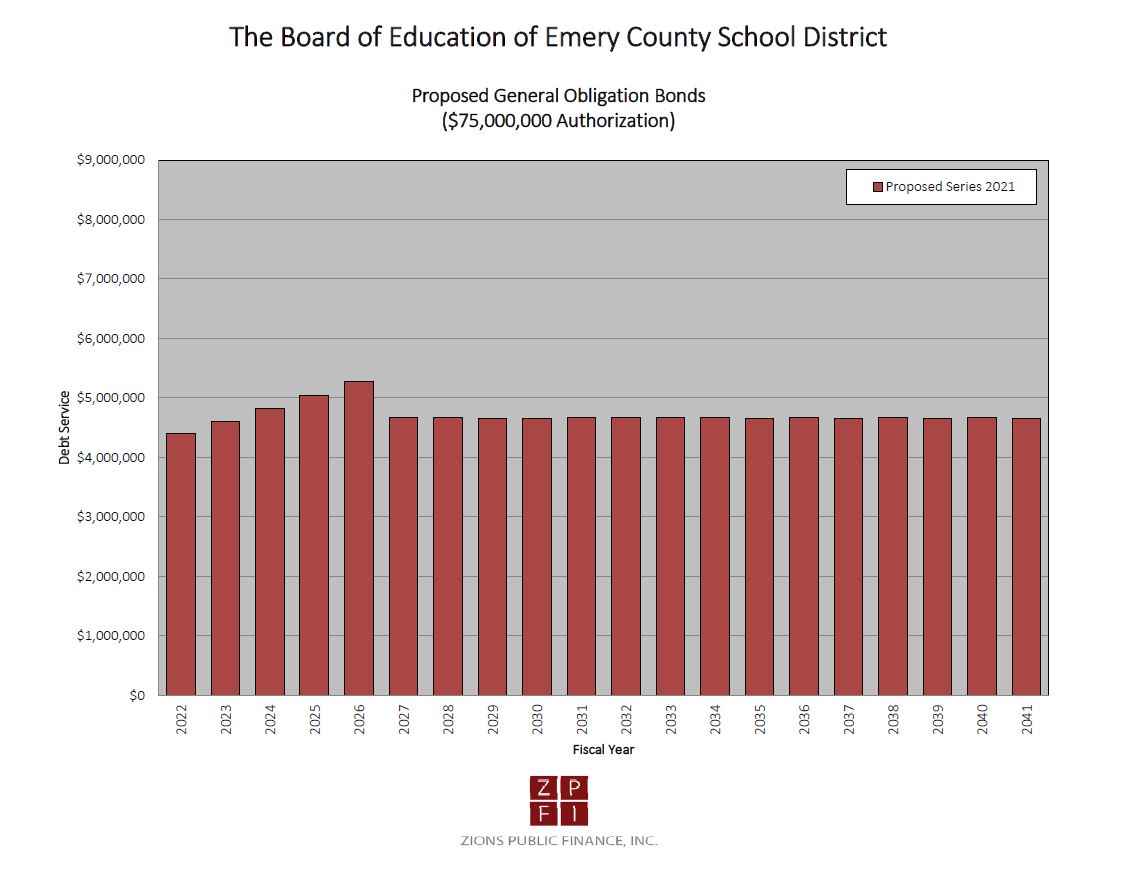

Projected Payment Schedule